Page 22 - Katalog seminářů MONECO Financial Training

P. 22

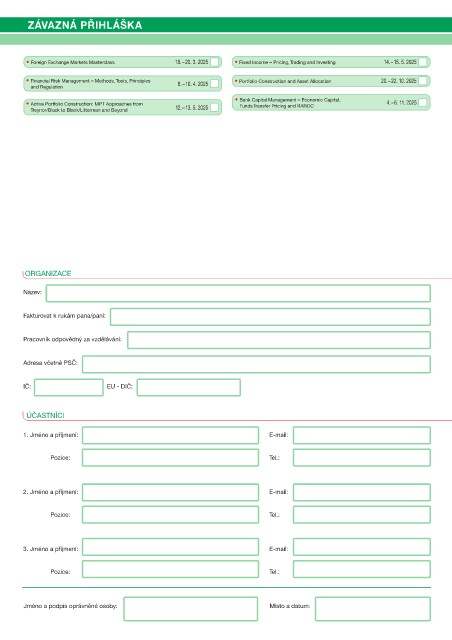

ZÁVAZNÁ PØIHLÁŠKA

• Foreign Exchange Markets Masterclass 18. – 20. 3. 2025 • Fixed Income – Pricing, Trading and Investing 14. – 15. 5. 2025

• Financial Risk Management – Methods, Tools, Principles 8. – 10. 4. 2025 • Portfolio Construction and Asset Allocation 20. – 22. 10. 2025

and Regulation

• Bank Capital Management – Economic Capital,

• Active Portfolio Construction: MPT Approaches from Funds Transfer Pricing and RAROC 4. – 6. 11. 2025

Treynor/Black to Black/Litterman and Beyond 12. – 13. 5. 2025

ORGANIZACE

Název:

Fakturovat k rukám pana/paní:

Pracovník odpovìdný za vzdìlávání:

Adresa vèetnì PSÈ:

IÈ: EU - DIÈ:

ÚÈASTNÍCI

1. Jméno a pøíjmení: E-mail:

Pozice: Tel.:

2. Jméno a pøíjmení: E-mail:

Pozice: Tel.:

3. Jméno a pøíjmení: E-mail:

Pozice: Tel.:

Jméno a podpis oprávnìné osoby: Místo a datum: