Page 8 - Katalog seminářů MONECO Financial Training

P. 8

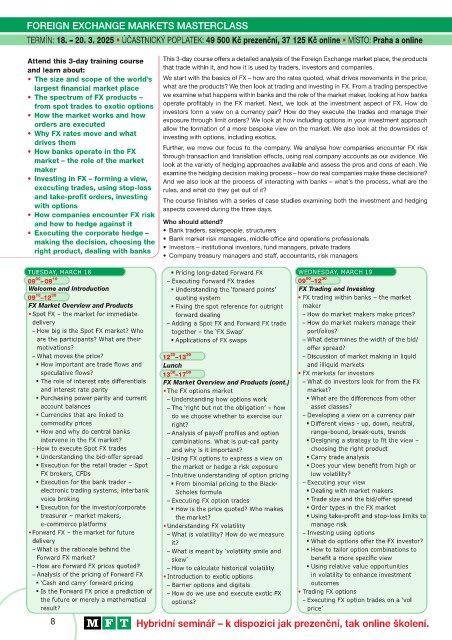

FOREIGN EXCHANGE MARKETS MASTERCLASS

TERMÍN: 18. – 20. 3. 2025 • ÚÈASTNICKÝ POPLATEK: 49 500 Kè prezenèní, 37 125 Kè online • MÍSTO: Praha a online

Attend this 3-day training course This 3-day course offers a detailed analysis of the Foreign Exchange market place, the products

and learn about: that trade within it, and how it is used by traders, investors and companies.

• The size and scope of the world’s We start with the basics of FX – how are the rates quoted, what drives movements in the price,

largest fi nancial market place what are the products? We then look at trading and investing in FX. From a trading perspective

• The spectrum of FX products – we examine what happens within banks and the role of the market maker, looking at how banks

from spot trades to exotic options operate profi tably in the FX market. Next, we look at the investment aspect of FX. How do

• How the market works and how investors form a view on a currency pair? How do they execute the trades and manage their

orders are executed exposure through limit orders? We look at how including options in your investment approach

• Why FX rates move and what allow the formation of a more bespoke view on the market. We also look at the downsides of

investing with options, including exotics.

drives them

• How banks operate in the FX Further, we move our focus to the company. We analyse how companies encounter FX risk

market – the role of the market through transaction and translation effects, using real company accounts as our evidence. We

maker look at the variety of hedging approaches available and assess the pros and cons of each. We

• Investing in FX – forming a view, examine the hedging decision making process – how do real companies make these decisions?

And we also look at the process of interacting with banks – what’s the process, what are the

executing trades, using stop-loss rules, and what do they get out of it?

and take-profi t orders, investing

with options The course fi nishes with a series of case studies examining both the investment and hedging

• How companies encounter FX risk aspects covered during the three days.

and how to hedge against it Who should attend?

• Executing the corporate hedge – • Bank traders, salespeople, structurers

making the decision, choosing the • Bank market risk managers, middle offi ce and operations professionals

right product, dealing with banks • Investors – institutional investors, fund managers, private traders

• Company treasury managers and staff, accountants, risk managers

TUESDAY, MARCH 18 Pricing long-dated Forward FX WEDNESDAY, MARCH 19

30

00

00

09 – 09 10 – Executing Forward FX trades 09 –12

Welcome and Introduction Understanding the ‘forward points’ FX Trading and Investing

10

30

09 –12 quoting system • FX trading within banks – the market

FX Market Overview and Products Fixing the spot reference for outright maker

• Spot FX – the market for immediate forward dealing – How do market makers make prices?

delivery – Adding a Spot FX and Forward FX trade – How do market makers manage their

– How big is the Spot FX market? Who together – the ‘FX Swap’ portfolios?

are the participants? What are their Applications of FX swaps – What determines the width of the bid/

motivations? off er spread?

– What moves the price? 12 –13 30 – Discussion of market making in liquid

30

How important are trade fl ows and Lunch and illiquid markets

speculative fl ows? 13 –17 00 • FX markets for investors

30

The role of interest rate diff erentials FX Market Overview and Products (cont.) – What do investors look for from the FX

and interest rate parity • The FX options market market?

Purchasing power parity and current – Understanding how options work What are the diff erences from other

account balances – The ‘right but not the obligation’ – how asset classes?

Currencies that are linked to do we choose whether to exercise our – Developing a view on a currency pair

commodity prices right? Diff erent views - up, down, neutral,

How and why do central banks – Analysis of payoff profi les and option range-bound, break-outs, trends

intervene in the FX market? combinations. What is put-call parity Designing a strategy to fi t the view –

– How to execute Spot FX trades and why is it important? choosing the right product

Understanding the bid-off er spread – Using FX options to express a view on Carry trade analysis

Execution for the retail trader – Spot the market or hedge a risk exposure Does your view benefi t from high or

FX brokers, CFDs – Intuitive understanding of option pricing low volatility?

Execution for the bank trader – From binomial pricing to the Black- – Executing your view

electronic trading systems, interbank Scholes formula Dealing with market makers

voice broking – Executing FX option trades Trade size and the bid/off er spread

Execution for the investor/corporate How is the price quoted? Who makes Order types in the FX market

treasurer – market makers, the market? Using take-profi t and stop-loss limits to

e-commerce platforms • Understanding FX volatility manage risk

• Forward FX – the market for future – What is volatility? How do we measure – Investing using options

delivery it? What do options off er the FX investor?

– What is the rationale behind the – What is meant by ‘volatility smile and How to tailor option combinations to

Forward FX market? skew’ benefi t a more specifi c view

– How are Forward FX prices quoted? – How to calculate historical volatility Using relative value opportunities

– Analysis of the pricing of Forward FX • Introduction to exotic options in volatility to enhance investment

‘Cash and carry’ forward pricing – Barrier options and digitals outcomes

Is the Forward FX price a prediction of – How do we use and execute exotic FX • Trading FX options

the future or merely a mathematical options? – Executing FX option trades on a ‘vol

result? price’

8 Hybridní semináø – k dispozici jak prezenèní, tak online školení.